Web Traffic & Web Updates Report | Q1 2023

Web Traffic & Analytics

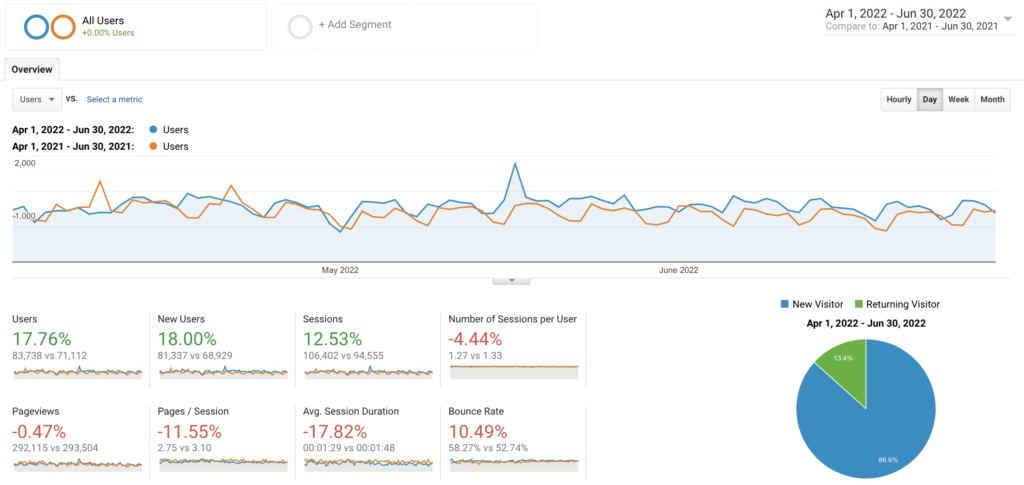

1. Overall Traffic

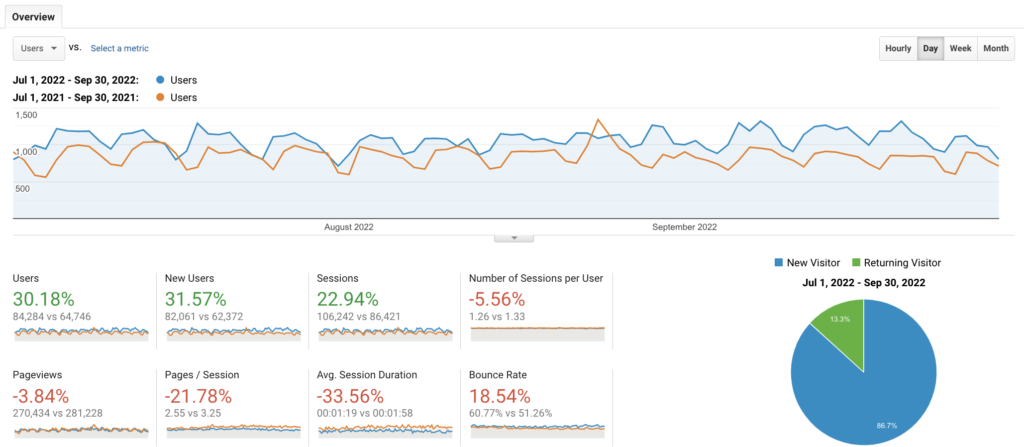

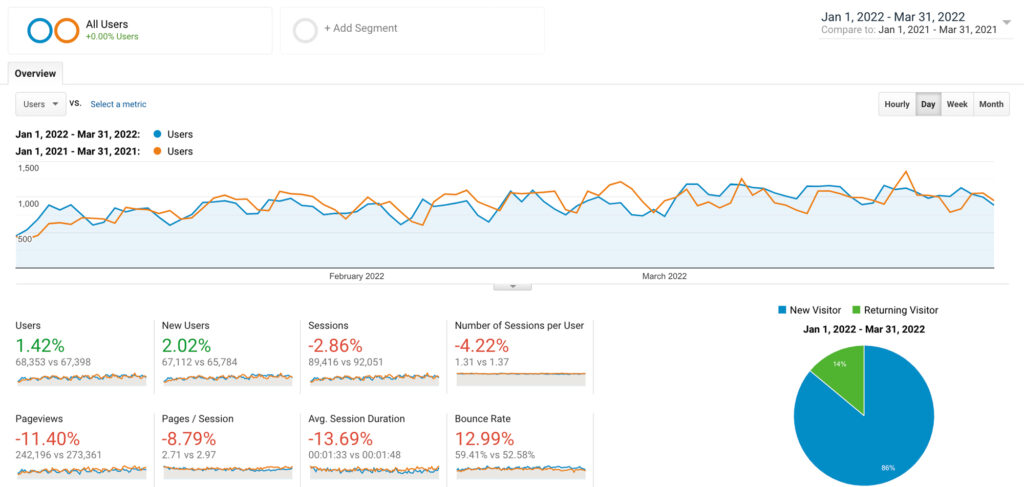

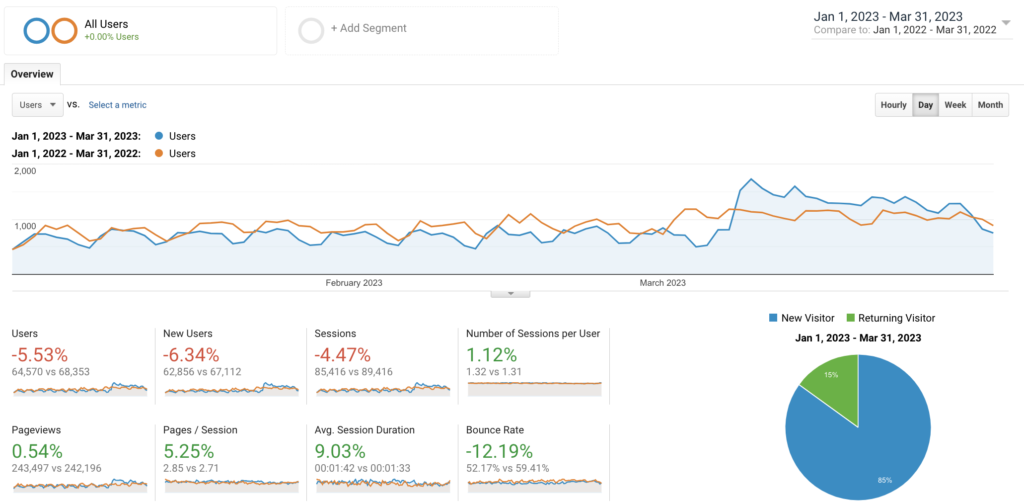

2023’s Q1 overall web traffic shows relatively flat performance compared to that of 2022 Q1. There was a minor decrease in total users, new users, and sessions. But with minor to moderate increase in page views, pages/session, avg. session duration, and bounce rate.

Overall users and new users were on high in January and February of 2023, compared to 2022, but fell short in March..

Overall web traffic in 2023 is up however, following multiple campaign efforts centered on small tractors, as well as general new content and site features.

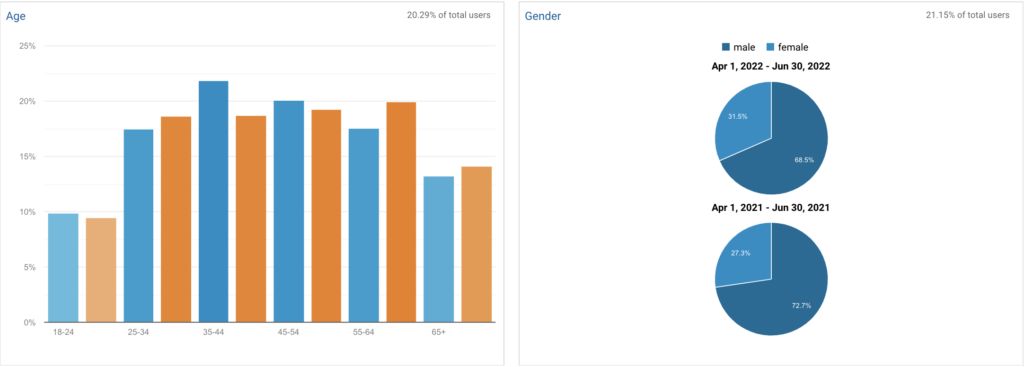

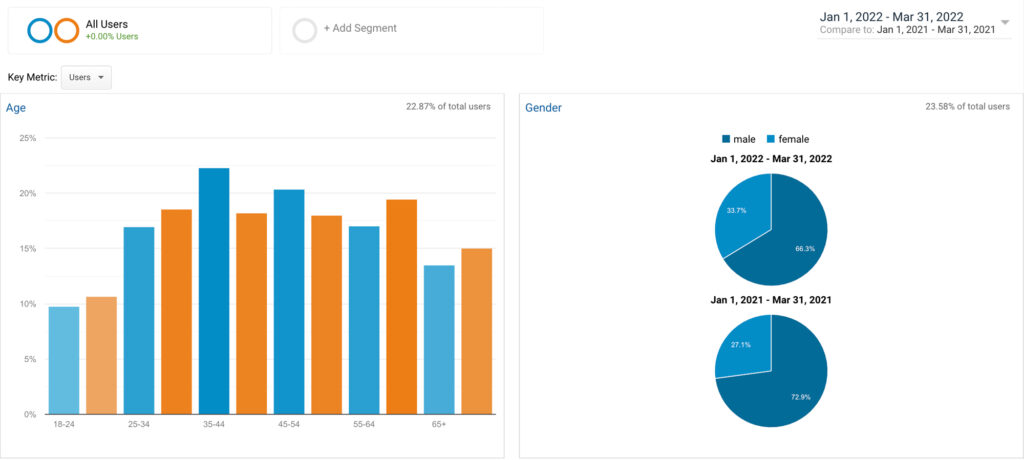

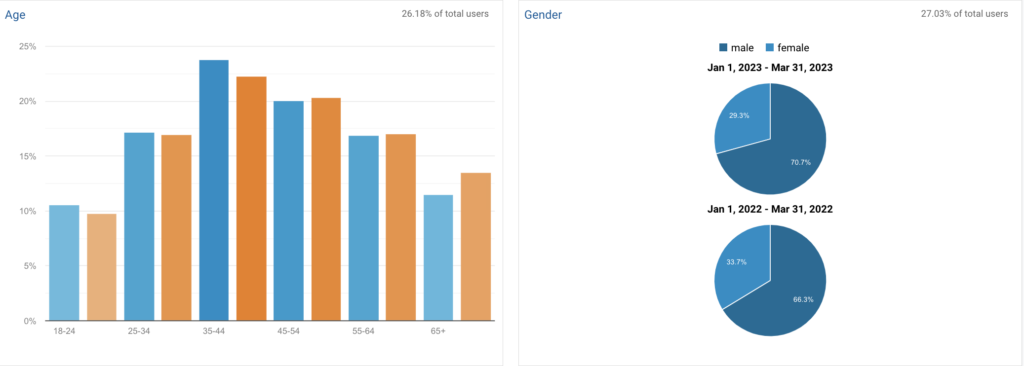

User demographics for 2023 Q1 show the continued trend of younger users and female users increasing. The demographic changes are small. The largest changes with respect to age in the increase in users aged 35-44 and the decrease in ages 65+. There was a ~4% increase in female users on the site.

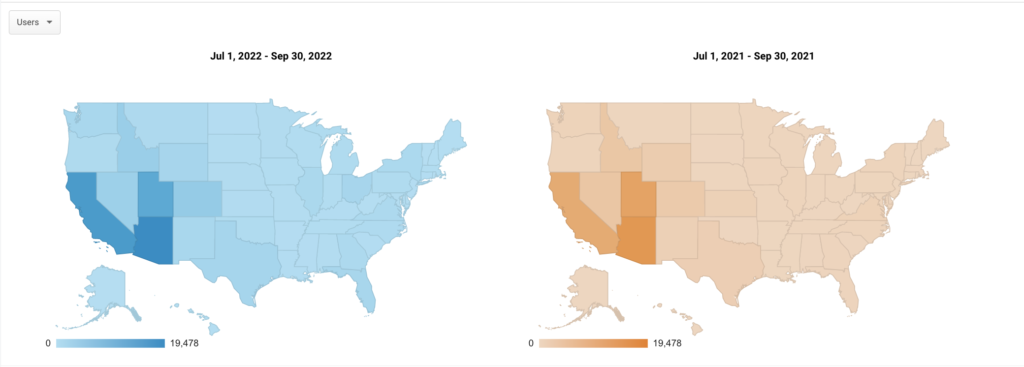

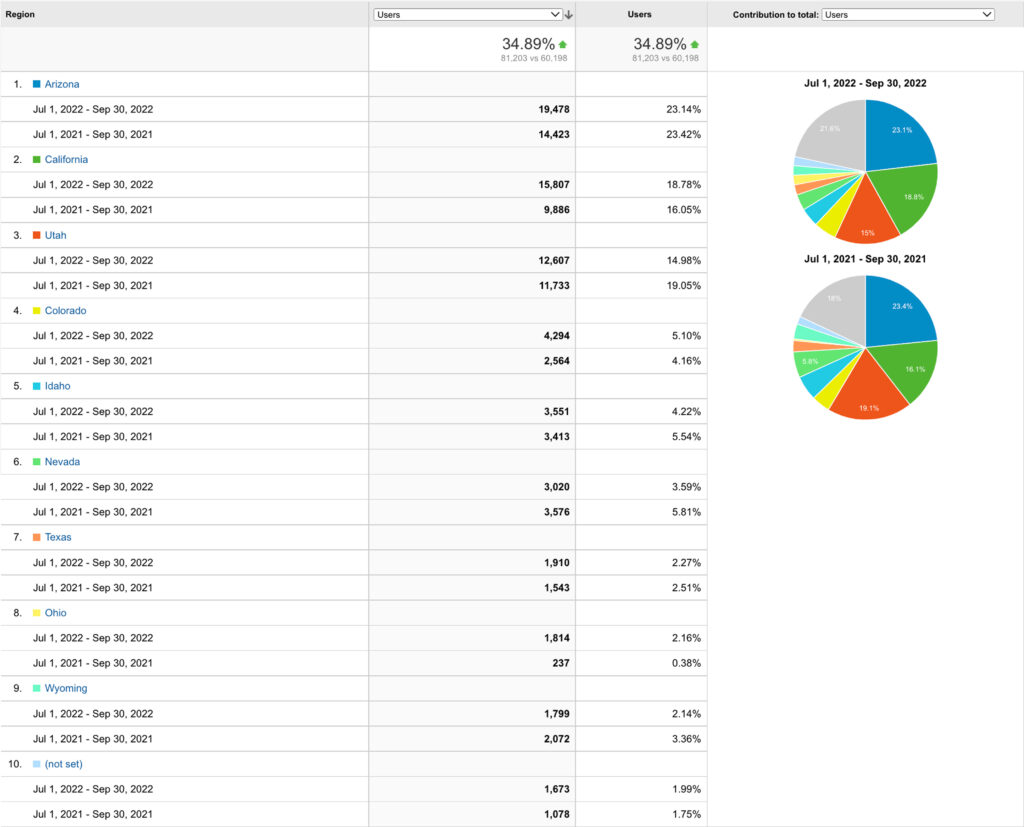

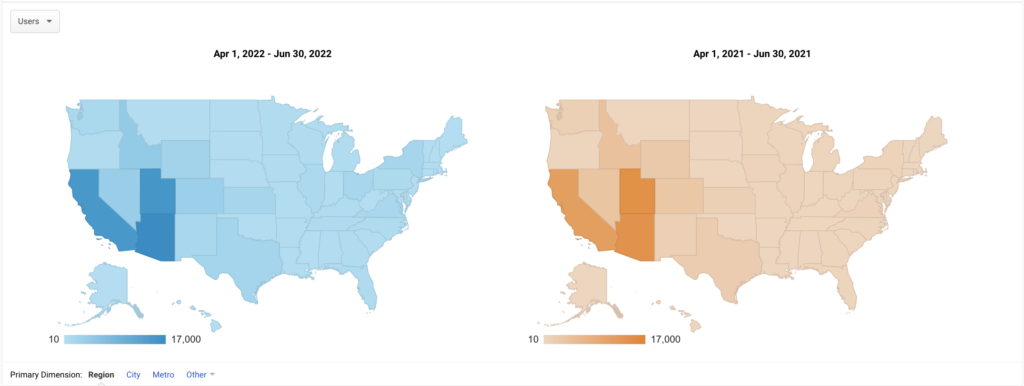

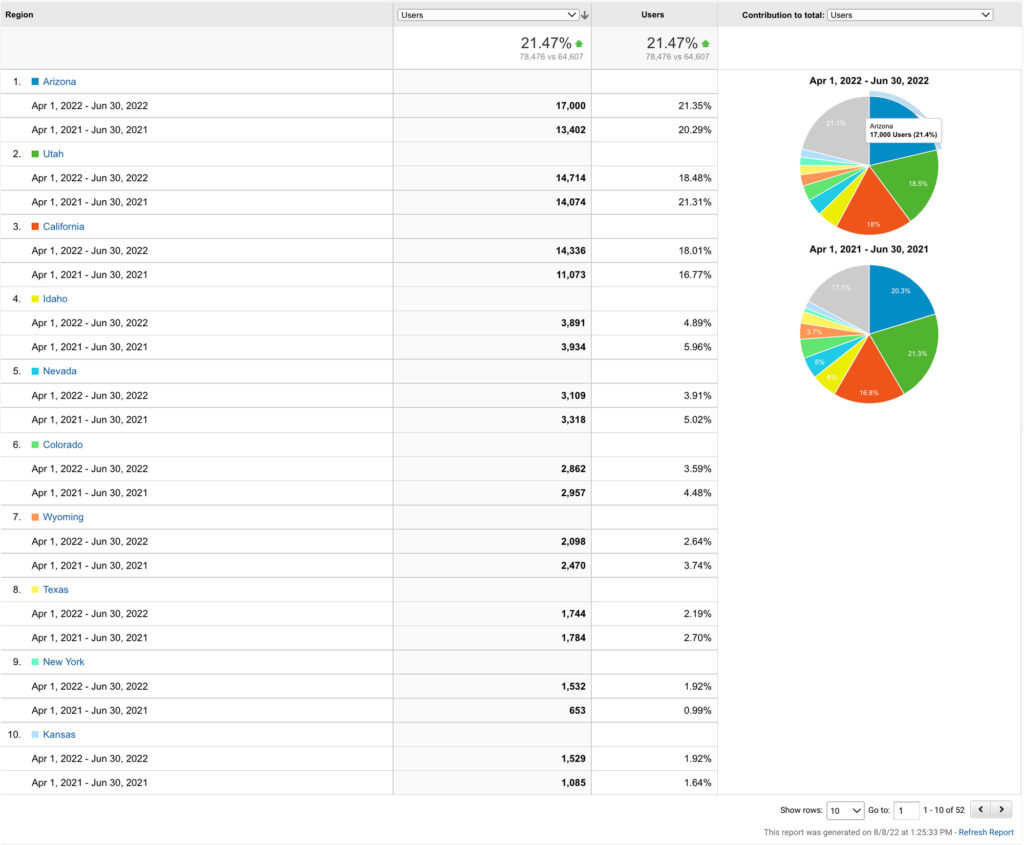

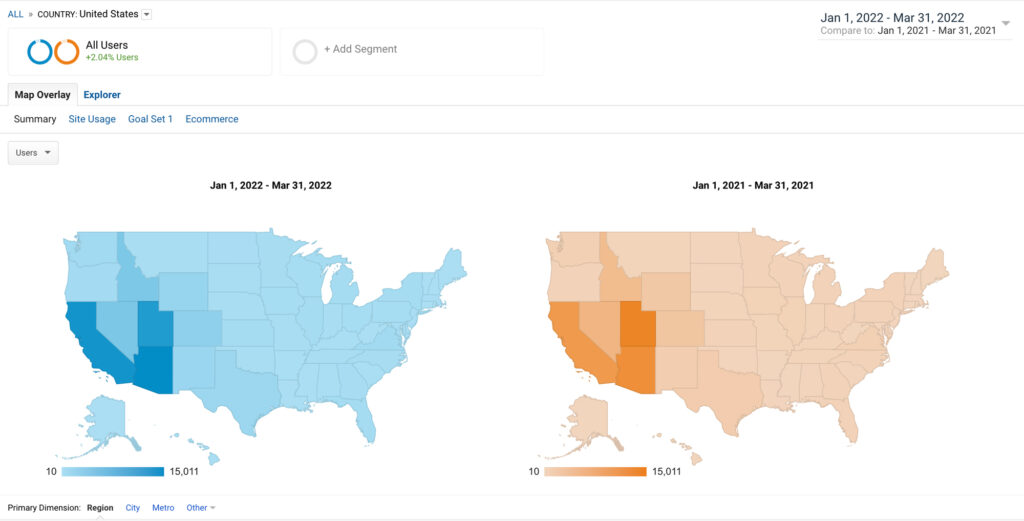

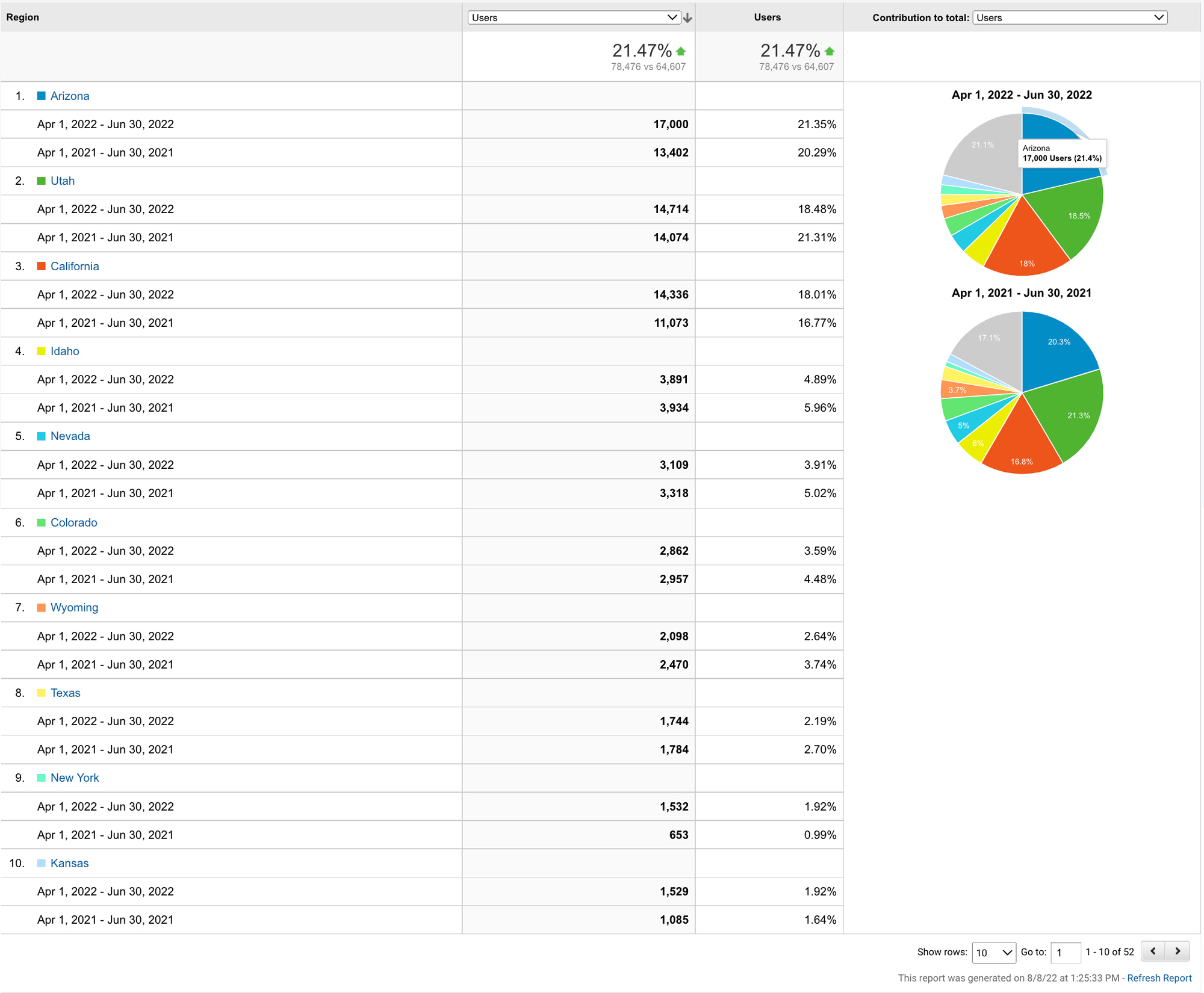

3. User location

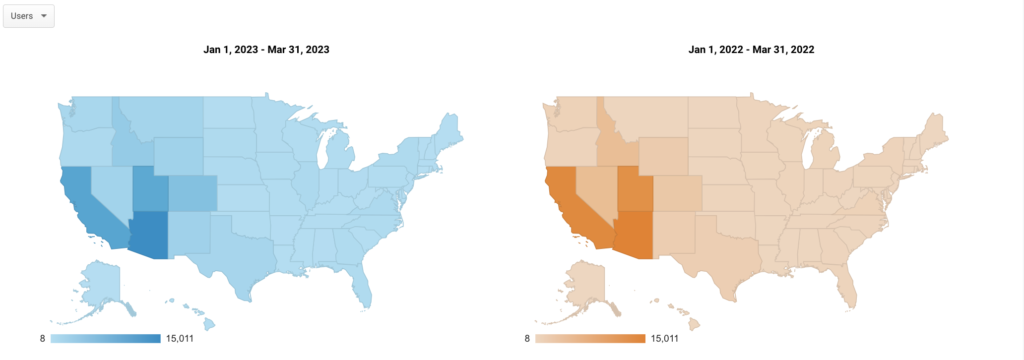

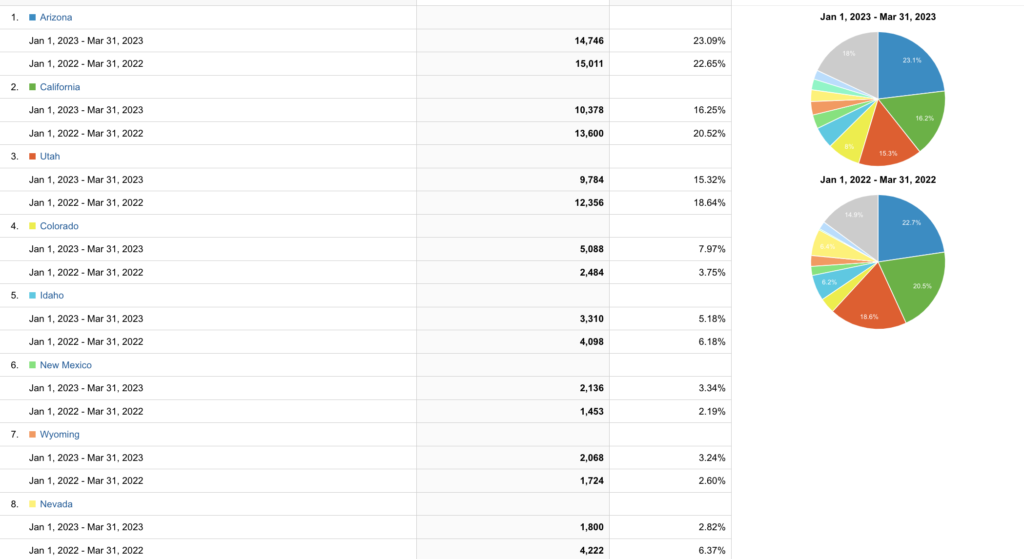

The location of website users in 2023 Q1 was consistent with that of 2022 Q1. This is a good thing as it shows that the vast majority of the site content is reaching customers and potential customers.

In 2021 Q1, there were increases in the total number of users in Colorado, Wyoming, and New Mexico, with decreases in our other 5 states, accounting for the total ~6% decrease in users in Q1.

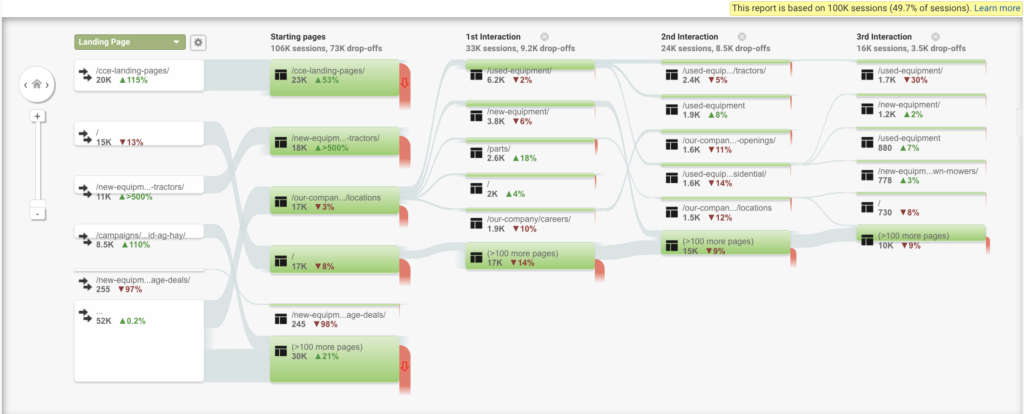

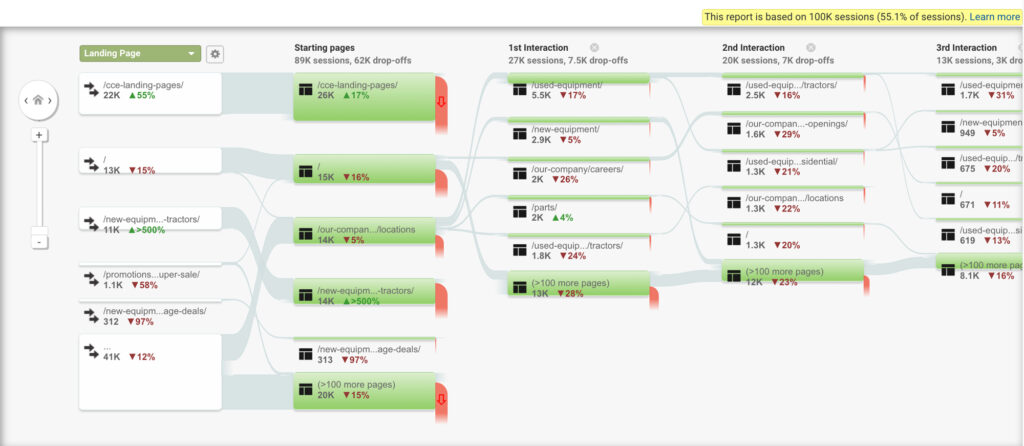

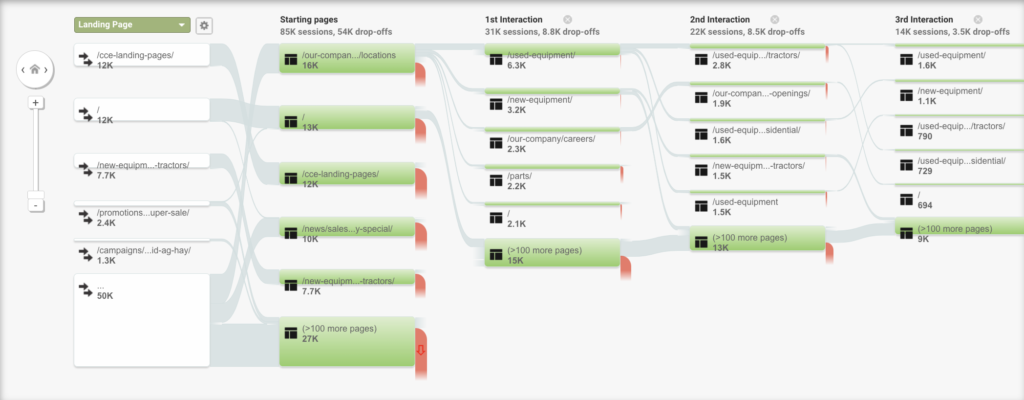

4. User Behavior/Content Flow

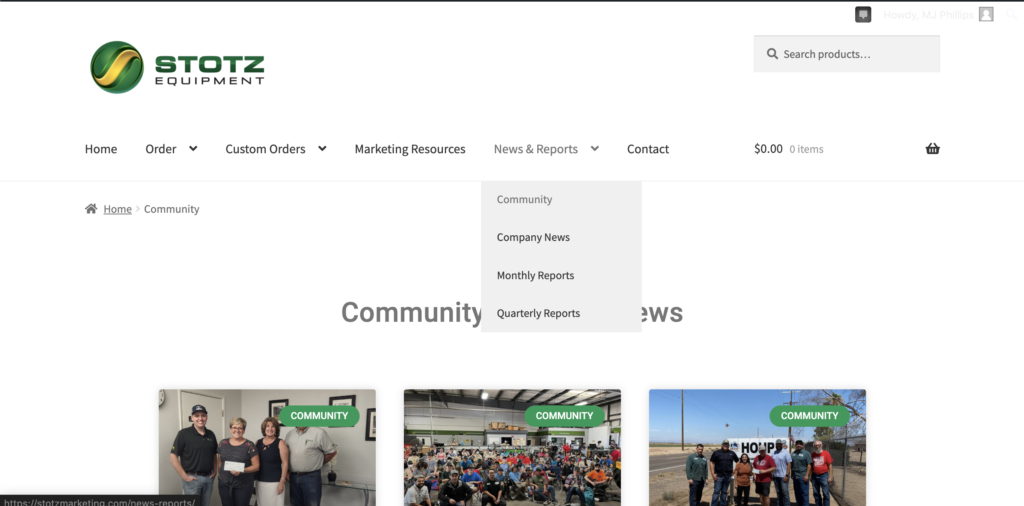

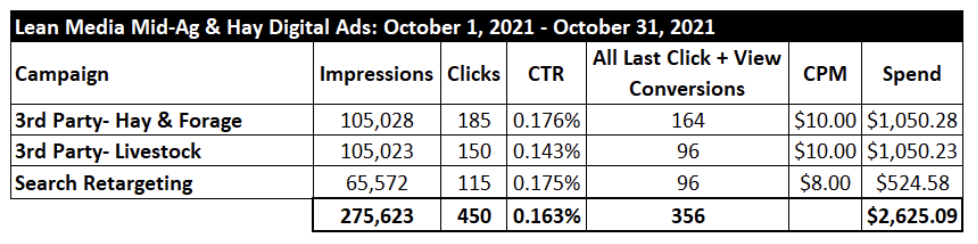

Behavior flow charts from 2023 Q1 show the effectiveness of CCE campaigns, organic traffic to the home page, small tractor campaigns, mid ag & hay campaigns, featured used equipment sales, recruiting efforts, as these are the most common entry points of the site.

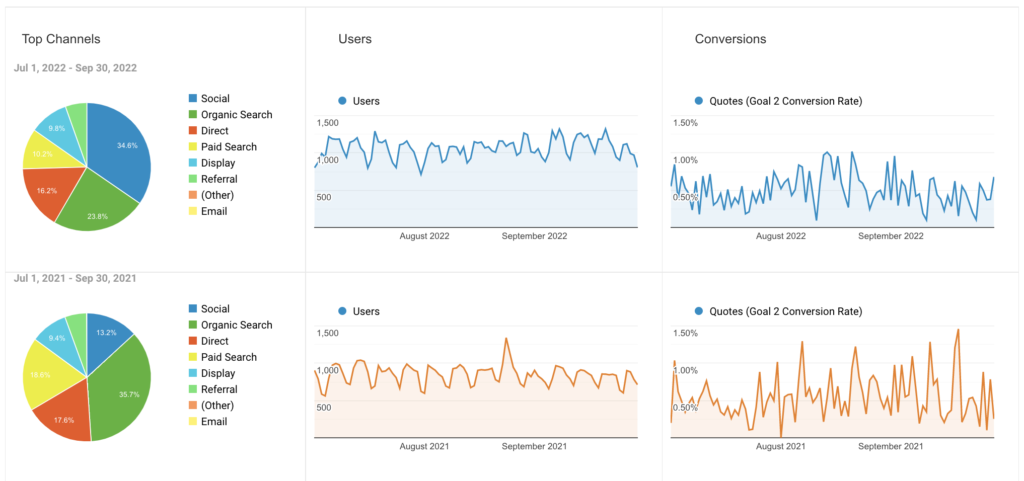

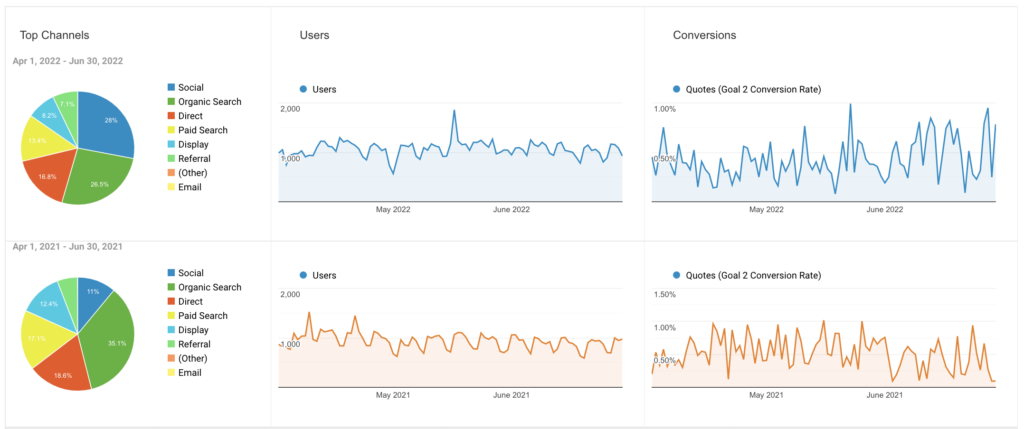

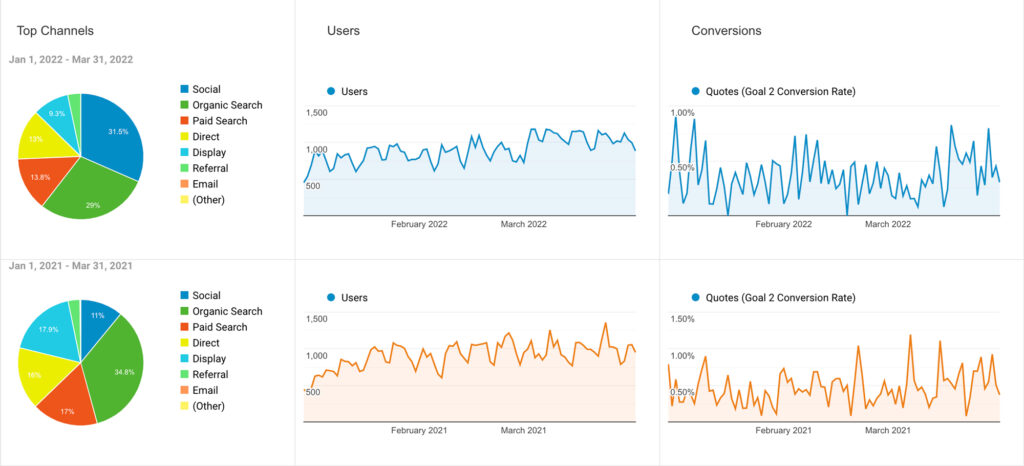

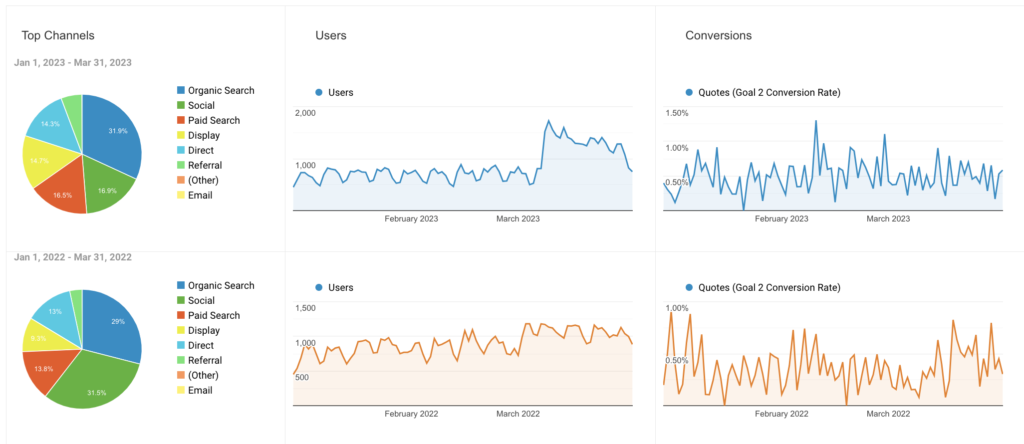

5. User Acquisition

The user acquisition in 2023 Q1 shows an overall more even distribution of traffic sources. The most significant source of traffic continues to be organic, as desired, with relatively even split between social media, paid search, display ads, and direct traffic. This is optimal. The smallest contributor is referral traffic as expected.

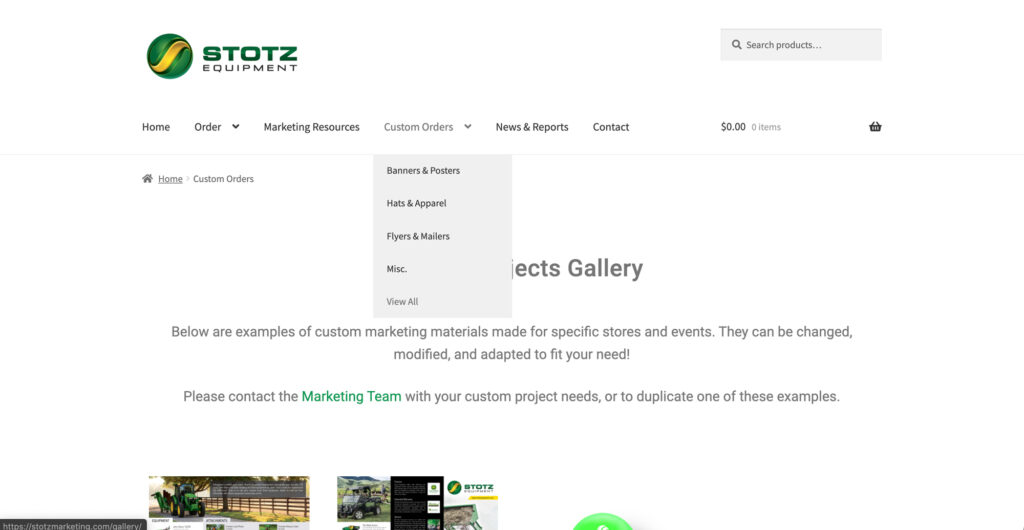

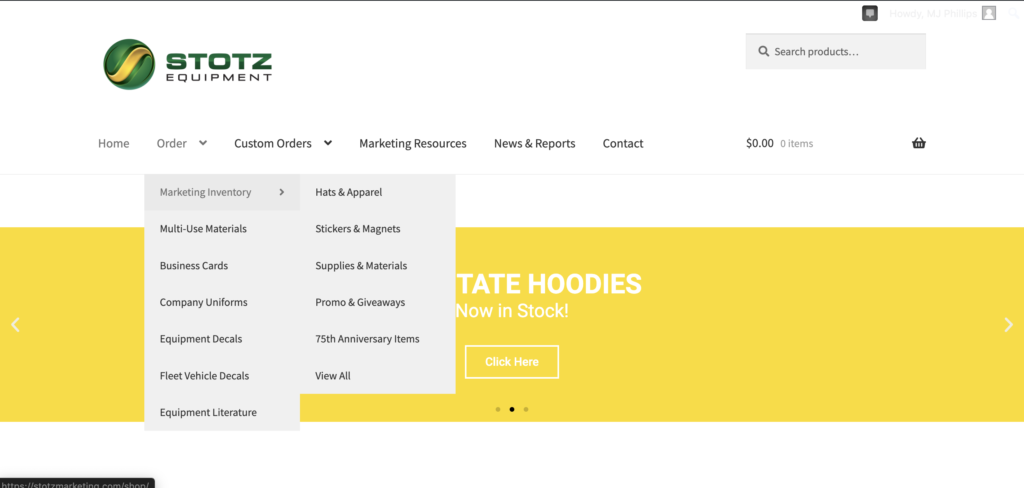

Website Updates & Improvements

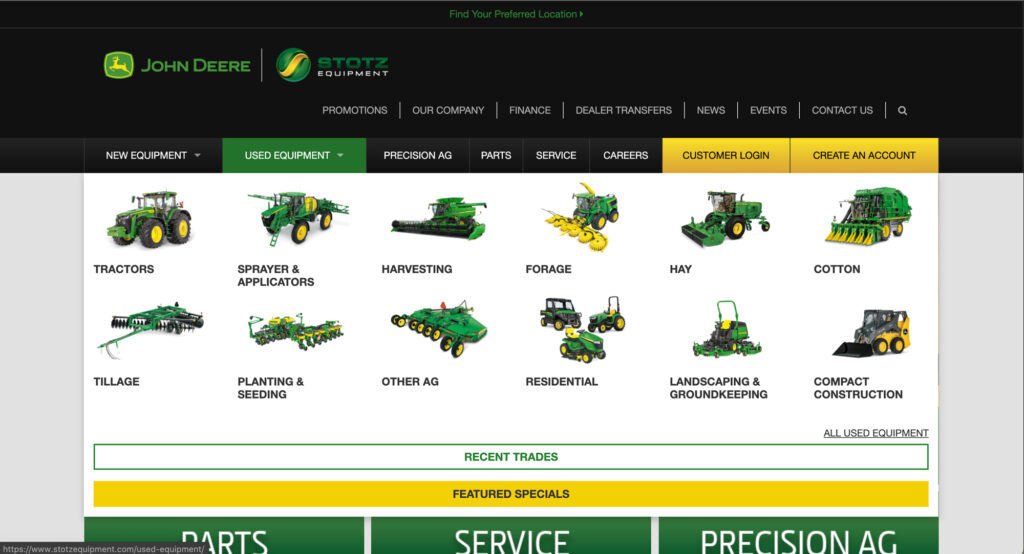

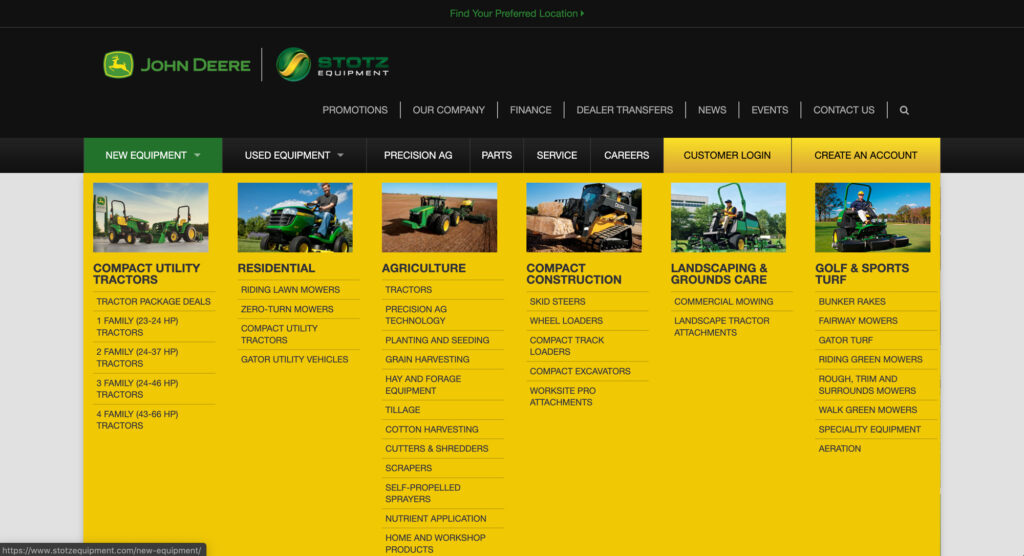

To coincide with increased efforts in the small tractor market, the CUTs category page has received a complete redesign including a lot of new content. The additional content and features serve to increase overall organic traffic as well as improve the user experience and encourage customer action and conversion once on the page. Click the screenshot below to visit the page.

Additionally, there is a new content section on the website dedicated to DIY video guides we have created and are continuing to create for our customers: